From RUGs to Riches: Nursing home whistleblowers show how a RUG score can show fraud.

What is RUG score?

A RUG (Resource Utilization Group) score in Medicare is used to determine the amount of reimbursement a facility receives for providing care to patients in skilled nursing facilities (SNFs). The score is calculated based on the level of care and resources required by the patient, including therapy minutes, clinical conditions, and activities of daily living.

Fraud can occur when a facility intentionally manipulates or upcodes RUG scores to receive higher reimbursements than they are entitled to. Here’s how this can happen:

Inflated Therapy Minutes: Facilities may report more therapy minutes than were actually provided to patients. Since therapy minutes are a key factor in determining the RUG score, inflating these numbers can result in a higher RUG score and, consequently, higher Medicare payments.

Falsified Medical Conditions: The facility might exaggerate or falsely document the severity of a patient’s medical condition or needs. By doing so, they can justify placing the patient in a higher RUG category, which commands more reimbursement.

Manipulating Activities of Daily Living (ADLs): ADLs include basic tasks like eating, bathing, and mobility. If a facility falsely reports that a patient requires more assistance with ADLs than they actually do, it can lead to a higher RUG score and increased payments.

Unnecessary Services: Facilities may provide and bill for unnecessary services or therapies that do not contribute to the patient’s well-being but are used to inflate the RUG score.

Upcoding: This occurs when a facility assigns a higher RUG level to a patient than is medically necessary or appropriate. By upcoding, the facility can maximize its reimbursement from Medicare, even though the care provided doesn’t justify the higher payment.

It’s the nursing facility that assigns the RUG score which has the potential to lead to fraud.

How a RUG score is calculated

A RUG score is calculated to classify patients in SNFs based on the level of care they need. The fundamental issue is that it’s the SNF that determines the RUG score—it’s basically like if you decided how much to pay yourself. The temptation is obvious.

The RUG score helps determine the Medicare reimbursement rate for the facility. Here's a breakdown of how the RUG score is calculated:

Assessment Tool: Minimum Data Set (MDS)

The calculation of a RUG score begins with the Minimum Data Set (MDS), a standardized assessment tool that captures information about a patient's physical and clinical conditions, needs, and care preferences. The MDS is completed by the facility’s clinical staff and is essential for determining the appropriate level of care.

Categories of RUGs

Patients are categorized into one of several RUGs based on the MDS assessment. The main categories include:

Rehabilitation: Focuses on patients requiring physical, occupational, or speech therapy.

Extensive Services: Includes patients needing extensive medical care (e.g., ventilators, IV medications).

Special Care: For patients with specific clinical needs (e.g., complex medical conditions).

Clinically Complex: Patients with multiple or significant medical conditions.

Impaired Cognition: Patients with cognitive impairments.

Behavioral Symptoms and Cognitive Performance: Patients with specific behavioral issues.

Reduced Physical Function: Patients primarily needing assistance with activities of daily living (ADLs).

Factors Influencing RUG Score

Therapy Minutes: The amount and intensity of physical, occupational, or speech therapy provided. The more therapy a patient receives, the higher the RUG level might be.

Activities of Daily Living (ADLs): This includes tasks like eating, bathing, dressing, and mobility. Patients who need more assistance with ADLs are typically assigned to higher RUG levels.

Medical Conditions: The presence of certain medical conditions or the need for specialized care can influence the RUG score.

Cognitive Status: Patients with cognitive impairments may be placed in different RUG categories depending on their level of cognitive function and associated needs.

Behavioral Issues: Certain behaviors that require additional staff attention and resources may impact the RUG classification.

Calculation Process

Scoring ADLs: The MDS assigns scores based on the patient’s level of independence with ADLs. These scores contribute to the RUG classification.

Therapy Utilization: The number of therapy minutes provided is categorized into ranges that correspond to different RUG levels.

Classification: The patient's overall assessment data (ADLs, therapy, medical conditions, etc.) is compared to the criteria for each RUG category. The patient is then placed in the highest RUG category that fits their profile.

RUG Category Assignment: The patient’s MDS data is processed through a computerized algorithm to assign them to one of the 66 RUG-IV categories, which is used under the Medicare system. Each category corresponds to a different level of resource use and reimbursement.

Reimbursement

The assigned RUG category determines the daily rate at which Medicare reimburses the facility for the care provided to the patient. Higher RUG categories typically result in higher reimbursement rates.

The scheme

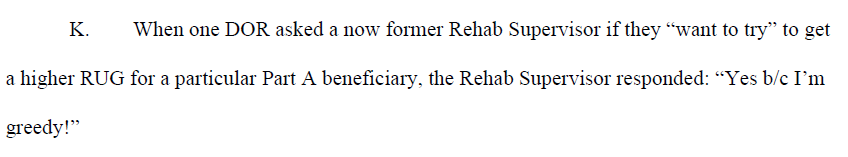

Strauss Ventures, LLC d/b/a/ The Grand Health Care System (the “Grand”) allegedly could not resist the temptation to pay themselves more than what they deserved. And they were not particularly subtle about it. As the Settlement Agreement recites:

In fact, the Grand found a lot of fraudulent reasons to pay themselves more than they were supposed to. The Settlement Agreement details several ways they were manipulating the system to get higher reimbursements than they were entitled to:

Budgeting for Ultra-High RUG Levels: Budgets were set with the expectation that most patients would be billed at the highest RUG level.

Presumptive Placement in Ultra-High RUG Levels: Patients were automatically placed in the ultra-high RUG category unless they couldn't tolerate the required therapy, rather than using individualized assessments.

Manipulating Therapy Minutes: Therapy minutes were planned to meet the minimum required for the ultra-high RUG level, with efforts made to avoid exceeding this threshold.

Corporate Control Over Therapy Plans: Corporate officials, unfamiliar with individual patient needs, adjusted therapy schedules to meet but not exceed the required minutes for the targeted RUG level.

Pressure to Complete Therapy: Therapists and patients were pressured to complete planned therapy minutes, even if patients were sick or unwilling.

Falsification of Therapy Minutes: More therapy minutes were reported than were actually provided.

Misreporting Initial Evaluation Time: Initial evaluations were falsely reported as therapy time to circumvent restrictions on counting evaluation time as therapy.

Misreporting Unskilled Services: Unskilled services were falsely reported as skilled therapy.

Prolonged Therapy Caseload: Patients were kept in therapy longer than medically necessary.

These actions reflect fraudulent practices designed to maximize Medicare reimbursements by manipulating the RUG scoring system.

The penalty

The Grand will pay $21.3 million to settle allegations they billed federal healthcare programs for services that were unreasonable, unnecessary, unskilled or that did not occur as billed.

It will also enter into a five-year Corporate Integrity Agreement (CIA) with HHS-OIG which will now send an independent regulator to assess The Grand and the facilities under their remit regarding Medicare Part A and TRICARE agreements.

The whistleblowers

Whistleblowers Stacey Rosenberger and Kelley Retig, sisters and former rehab providers for The Grand system, will collect more than $4 million for their part in drawing attention to questionable practices that initiated the widespread federal investigation.

Under the qui tam provision of the False Claims Act, a private party (also referred to as a whistleblower or relator) may file an action on behalf of the United States and receive a portion of the recovery, typically between 15-30%.

If you think you’ve observed fraud or misconduct, we can evaluate your options. Vivek Kothari is a former federal prosecutor who represents whistleblowers. For a free consultation, contact Vivek by email, phone, Signal, or fill out the contact form.